50YearTrader

Public #10

‘Back in the day’ meaning the early part of this century, news trading in FOREX was as close to free money as the markets ever offered. The only other such time in this writer’s memory was in the late 1970s when penny oil stocks would be subscribed to at ten-cents and open for trading at a dollar or more. The game of course was prying some loose from the brokers who were allocated blocks of them!

As to the early days of FX news trading “Too many traders making too much money too easily” cannot last long said my mentor. Brokers took counter measures, the markets adjusted, and the almost-free lunch ended.

‘News Trading’ as the term is most used by traders, involves trying to catch the fast pips that occur when a news release offers unexpected numbers, and the market runs in one direction quickly. There are several FOREX calendars available online which offer the ‘expected’ number for an upcoming news release. I use the Forex Factory calendar. How far from that expectation the real number falls determines how violently the market reacts.

News trading is still done; there are even software tools to aid the latter-day news trader. But its not the easy money it was 20 years ago and can also be risky if you get whip-sawed. Sometimes the news appears unexpectedly bullish, but then the next statement or set of numbers is decidedly bearish. Occasionally it is taken bullish immediately and bearish a minute later! The single report which, historically, has shown a large differential between ‘expected’ and ‘actual’ is the USD Non-Farm Payroll (NFP) release the first Friday of each month at 8:30 AM Eastern Time.

In 2005 this writer and his late ace lead programmer, James Bickford, published the eighth and final volume of the Currency Companion books titled, Shockwave Analysis.

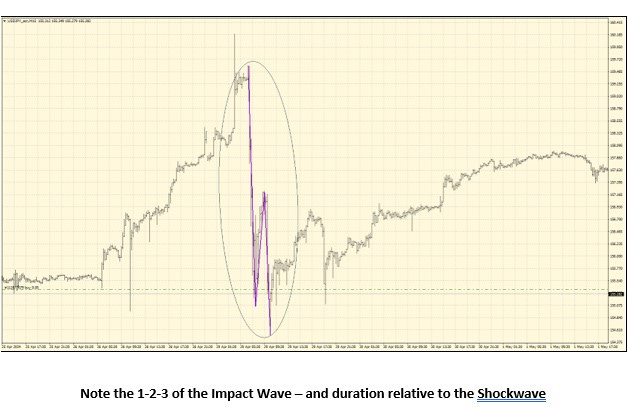

Archer and Bickford, through some intensive study and testing, found the price behavior after unexpected news or numbers could be condensed to six patterns. They labelled that initial movement the Impact Wave.

50YearTraderTip: The Impact Wave almost always has two pulses.

Goodman student extraordinaire, Dr. Thomas Lowe, discovered the ‘Make the Setup’ trade after the Impact Wave had finished. In the Make the Setup trade, the Impact Wave builds the final needed swing (‘SPS’) for a Goodman setup!

Most significantly, however, Archer and Bickford found the behavior of prices AFTER the Impact Wave – which they labelled the Shockwave – was often predictable based on the Impact Wave pattern.

While the Impact Wave typically lasted only a few minutes, the Shockwave might last for hours. As it turns out, the Shockwave of prices is very tradable – for the average trader probably more tradeable than the short-lived Impact Wave.

While the author no longer indulges in such activities, those with a taste for news trading may consider two interesting websites – NewsImpact and TradeThatSwing. Both seem to have discovered there is more to be had AFTER the initial news impact.

The serious trader may want to examine a year or two or three of the NFP Reports and the market reaction to them in the 1-Minute or 5-Minute time-frame. Perhaps he or she will discover some patterns and opportunities for profit.

Good Trading,

Michael Duane Archer